how to claim new mexico solar tax credit

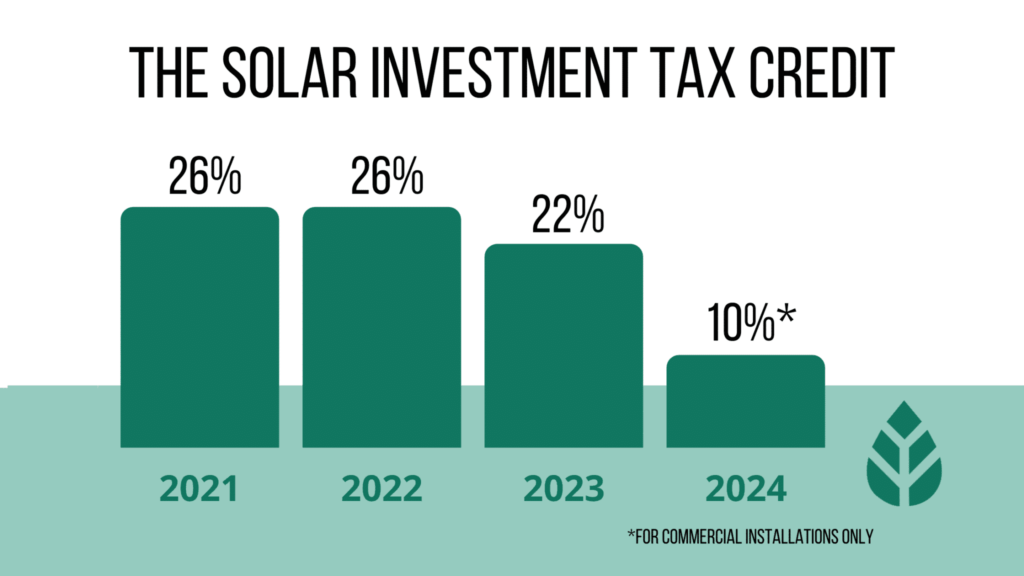

The federal tax credit falls to 22 at the end of 2022. For wind and biomass projects it offers a one cent per kilowatt-hour kWh tax credit and for solar it averages 27 cents per kWh.

Oil Companies Are Collapsing Due To Coronavirus But Wind And Solar Energy Keep Growing The New York Times

If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200.

. The federal solar tax credit. For an 18000 system the total cost reduction in this example would be. While the 30 Federal Tax Credit for solar is set to begin ramping down at the end of 2019 a new bill SB29 introduced into the 2019 legislative session would reintroduce the New Mexico Solar Tax Credit.

Geothermal Heat Pump Tax Credit HB 375 signed in April 2009 created a tax credit in New Mexico for geothermal heat pumps purchased and installed between January 1 2010 and December 31. The tax credit applies to residential commercial and agricultural installations. The New Mexico solar tax credit is Senate Bill 29.

If you install your photovoltaic system in 2020 the federal tax credit is 26 of the cost of your solar panel system. Lets say you install an 18000 solar panel system on your home. Form 5695 calculates tax credits for a variety of qualified residential energy improvements including geothermal heat pumps solar panels solar water heating small wind turbines and fuel cells.

New Mexico state solar tax credit. An applicant shall apply for the state tax credit with the taxation and revenue department and provide the certification and any other information the tax and revenue department requires within 12 months following the calendar year in which the system was installed. New Mexico state solar tax credit.

12790 Approximate system cost in NM after the 26 ITC in 2021. See below for forms. The federal tax credit for residential energy property applies to solar-electric systems solar water heating systems fuel cells small wind-energy systems and geothermal heat pumps.

For property owners in New Mexico perhaps the best state solar incentive is the states solar tax credit. The New Mexico Energy Minerals and Natural Resources Department EMNRD. The residential ITC drops to 22 in 2023 and ends in 2024.

A taxpayer may claim a credit of 30 of qualified expenditures for a system that serves a dwelling unit located in the United States that is owned and used as a residence by the taxpayer. Follow the four steps below to submit the application and documentation needed by ECMD to review and approve your New Solar Market Development Income Tax Credit. The current 30 solar tax credit will apply to any solar.

Well use 25000 gross cost of a solar energy system as an example. Filing Your Solar Tax Credit. The New Solar Market Development Income Tax Credit was passed by the 2020 New Mexico Legislature.

The solar market development tax credit may be claimed by a taxpayer who files a New Mexico personal or fiduciary income tax return for a tax year beginning on or after January 1 2006 and has purchased and installed a qualified photovoltaic or a solar thermal system after January 1 2006 but before December 31 2016 in a residence business or agricultural enterprise in New. Your state tax credit would be equal to. The balance of any refundable credits after paying all taxes due is refunded to you.

Thats right youll get back 10 of the cost of the solar panels and the installation cost. EMNRD administers this incentive and developed the rule which has been instrumental in the expansion of wind and solar resources. Claiming the New Mexico Solar Tax Credit.

This incentive can reduce your state tax payments by up to 6000 or 10 off your total solar energy expenses whichever is lower. Once a credit application is approved by EMNRD complete and attach Form RPD-41317 Solar Market Development Tax Credit Claim Form including Schedule A to your New Mexico income tax return along with the applicable tax credit Schedule PIT-CR or FID-CR. For fiscal-year and short-year returns enter the beginning and ending dates of the tax year.

For best results download and save the NSMD Application Form and fill it out using a PDF application which has been tested and verified to produce a form compliant with AcroForm standards. Note that because reducing state income taxes increases federal income taxes paid the two tax credits are not additive ie not 25 26 51. CLAIMING THE STATE TAX CREDIT.

See form PIT-RC Rebate and Credit Schedule. Schedule PIT-CR is used to claim non-refundable credits. However it can take some time.

However if youre a homeowner you can still take advantage of the investment tax credit offered by the federal government from now until 2021 as long as your system is operational. The PIT-RC Rebate and Credit Schedule is a separate schedule to claim refundable credits. This is an amazing opportunity to take advantage of this tax credit and invest in the future of energy.

The process to claim the New Mexico solar tax credit is simple. New Mexicos previous solar tax credit system expired in 2016. So the ITC will be 26 in 2020 and 22 in 2021.

It provides a 10 tax credit with a value up to 6000 for a solar system. To be eligible to claim a credit the taxpayer must employ at least one new full-time employee for every 500000 of expenditures up to 30000000 and at least one new full-time employee for every 1000000 of expenditures over 30000000. 18000 026 18000 1 022 025 4680 3510 8190.

Enter the four-digit year if the credit was claimed in a calendar year. The process requires some certifications and filling out forms which can extend the timeline. This new legislation gives a 10 income tax credit to homeowners who purchase solar equipment and installation.

7 Average-sized 5-kilowatt kW system cost in New Mexico. See below for forms. But the new solar tax credit really pushes your savings over the top making solar an even better investment than it was in the past.

This is 26 off the entire cost of the system including equipment labor and permitting. Buy and install new solar panels in New Mexico in 2021 with or without a home battery and qualify for the 26 federal solar tax credit. A copy of the letter from EMNRD certifying the project must also be attached.

Non-refundable credits can be used to reduce tax liability but if the tax due. Each year after it will decrease at a rate of 4 per year. Click New Solar Market Development Continue Enter up to three credit certificates and the amount of credit applied to tax.

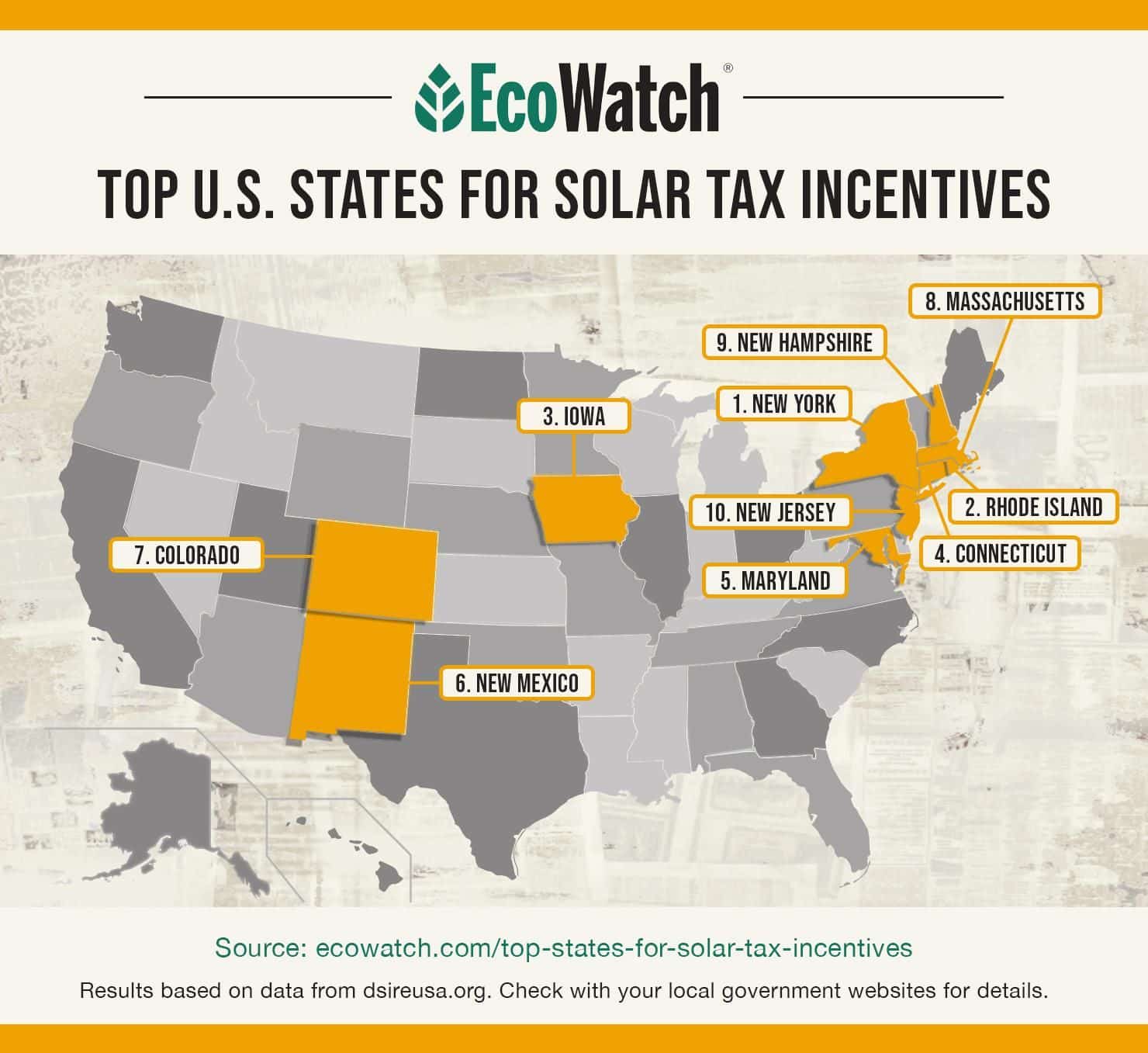

The investment tax credit ITC which is also known as the federal solar tax credit gives people in the United States the chance to subtract 26 percent of the cost of installing. New Mexico Solar Tax Credits. New Mexico solar tax credits make the state one of the most progressive governments in the country when it comes to supporting renewable energy projects.

It is taken in the tax year that you complete your solar install. The Residential Solar Investment Tax Credit ITC for the total cost of solar installation goes until 2019 at 30. Even before the return of the state tax credit switching to solar in New Mexico would bring you substantial savings on your electric bill.

Enter your energy efficiency property costs. Fill Out the Application. For each credit claimed in a previous tax year with unused credit available for carry forward enter the tax year in which the credit was first claimed.

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Seniors Need To Claim These Benefits Debt Relief Programs Best Money Saving Tips Senior Discounts

Federal Solar Tax Credit 2022 How Does It Work Sunpro Solar

Solar Tax Exemptions Sales Tax And Property Tax 2022

New Mexico Solar Incentives Rebates And Tax Credits

Solar Panel Users To Be Paid For Excess Power But Will Need To Wait Solar Power The Guardian

Nem 3 0 Erodes Solar Value Makes Batteries Essential And Weakens Grid Flexibility In California Pv Magazine Usa

Uk Firm S Solar Power Breakthrough Could Make World S Most Efficient Panels By 2021 Manufacturing Sector The Guardian

Storage Roundup New Projects In Ma Canada Greenko Phes Deal

How The Solar Tax Credit Makes Renewable Energy Affordable

Citi 10 Innovations That Will Change The Future Of The Global Economy

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

Federal Solar Tax Credit How Much Will You Get Back 2022

11 Smart Questions Answered The Facts On Massachusetts New Solar Program Climate Xchange

2022 Solar Incentives By State Top 10 States For Solar Panels Ranked

New Mexico Solar Incentives Rebates And Tax Credits

Customer Solar Program Pnmprod Pnm Com

Sydney Solar Panel Installation Buyer S Guide Solar Run

Bnef Up To 194gw Of Solar Could Be Installed In 2021 As Investments Soar Pv Tech