when will capital gains tax rate increase

When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. This would bring the capital gains tax rates to the levels comparable to the early 2000s when it was last equalised with income tax.

Pin On Africa News And Politics

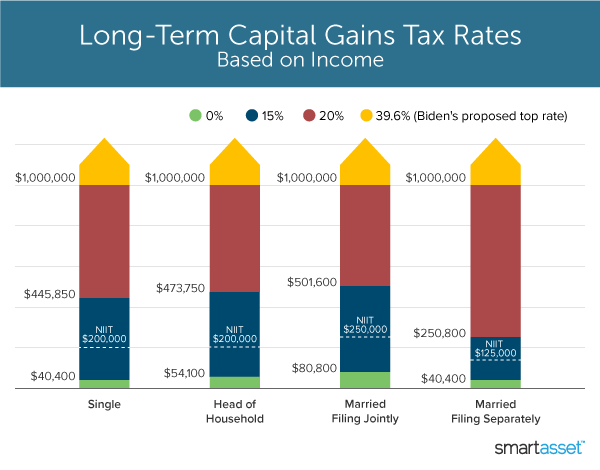

Long-term capital gains are taxed at the rate of 0 15 or 20 depending on a combination of your taxable income and marital status.

. Additionally a section 1250 gain the portion of a. President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from 238 percent today to 396 percent for higher earners. Currently the capital gains rate is 20 for single taxpayers with income over 441451 and for taxpayers who are married filing jointly with income over 496601.

The recent passage of Bill C-208 exacerbates these issues. Capital gains are part of the taxpayers comprehensive income and in a fair and efficient tax system they should be subject to taxation just like other income. Dramatic increase in IRS capital-gains transactions as Biden administration considers raising tax rates on the wealthy Last Updated.

Capital Gains Tax Rate 2022. Hawaiis capital gains tax rate is 725. If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28.

There is currently a bill that if passed would increase the. This will affect long-term and short-term capital gains since both would be taxed as ordinary income in the highest bracket. The rates do not stop there.

NDPs proto-platform calls for levying. 22 2021 at 1256 pm. Understanding Capital Gains and the Biden Tax Plan.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. Basic rate taxpayers would face an increase of 10 to 20 capital gains tax or higher rates on large gains treated as the top slice of income. The table also shows the inclusion Eligible.

If this were to happen it may not only. Tax on capital gains would be increased to 288 percent by House Democrats. To fund the BBB original drafts included widespread tax increases on individuals and corporations including an increase in the capital gains rate for transactions occurring after September 13 2021.

The federal government and many states have specific tax systems for capital gains income. To increase their effective tax rate to 20 percent the household must remit an additional 12 million in tax 3 million in taxes paid with a 15 million income inclusive of unrealized gains. Instead the BBBA as currently drafted would increase the highest capital gains tax rate to 25 and maintain a graduated rate structure for 0 and 15 capital gains tax rates.

Section 1256 of the Internal Revenue Code requires that option contracts on futures commodities currencies and broad-based stock market indices be taxed with a 6040 split between long-term and short-term capital gains rates. Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021. To fix these problems the inclusion rate for capital gains should rise to 80 per cent from the current 50 per cent.

While the proposed increase is not as severe as originally feared the top capital gains tax would see an increase from 20 to 25. The effective date for this increase would be September 13 2021. That applies to both long- and short-term capital gains.

It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021. Appendix Top 2020 marginal tax rates for capital gains and dividends The following table illustrates the current top marginal tax rate on capital gains by provinceterritory as well as the potential top marginal tax rate on capital gains if the inclusion rate increases to 66 2 3 or 75. For single tax filers you can benefit from the zero percent.

Top Combined Capital Gains Tax Rates Would Average 48 Percent Under Bidens Tax Plan. In addition to raising the capital-gains tax rate House Democrats legislation would create a 3 surtax on individuals modified adjusted gross income exceeding 5 million starting in. According to a House Ways and Means Committee staffer taxpayers who earn more than 400000 single 425000 head of household or 450000 married joint will be subject to the highest federal tax rate beginning in 2022.

The proposal would increase the maximum stated capital gain rate from 20 to 25. Additionally the change to 25 could be effective. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28.

The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. Capital gains tax rates on most assets held for a year or less correspond to. This increase would retroactively apply to capital gains recognized after Sept.

Capital Gains Tax Brackets 2021 What They Are And Rates Capital Gains Tax Tax Brackets Capital Gain

Capital Gains Tax What Is It When Do You Pay It

Can Capital Gains Push Me Into A Higher Tax Bracket

Any Gain That Arises From The Sale Of A Capital Asset Is A Capital Gain This Gain Or Profit Is Comes Under Th Capital Gains Tax Capital Gain Financial Peace

How To Save Capital Gains Tax On Property Sale Capital Gain Capital Gains Tax Tax

Mechanics Of The 0 Long Term Capital Gains Rate Capital Gain Capital Gains Tax Tax Brackets

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

The Long And Short Of Capitals Gains Tax

What S In Biden S Capital Gains Tax Plan Smartasset

Mechanics Of The 0 Long Term Capital Gains Rate Capital Gain Capital Gains Tax Tax Brackets

Pin By Sam Dogen On Career Work Capital Gains Tax Capital Gain Financial

Biden S Capital Gains Tax Hike Could Spark A Big Sell Off In Stocks Here S What That Means For The Market Capital Gains Tax Capital Gain Pension Fund

Capital Gains Definition 2021 Tax Rates And Examples

Options Trading Taxes For All Traders Option Trading Futures Contract Capital Gains Tax

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)